This year we changed our life insurance carrier to The Hartford and they are allowing employees to have a special enrollment. During this special enrollment period, you can elect up to $250,000 of life insurance coverage without providing Evidence of Insurability (EOI). You may also elect up to $40,000 of coverage for your spouse without EOI during this enrollment. Child coverage is also available at $5,000 or $10,000. Don't miss this unique opportunity to enroll or increase your coverage without the extra paperwork.

You will be able to make these changes in our online benefits platform, AFenroll, from 10/26/2020 – 10/30/2020.

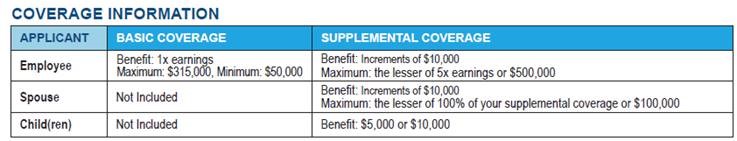

Below is a summary of our Plan benefits from The Hartford.

These are the monthly costs per $1,000 of coverage. If you want $100,000 worth of coverage and you are 52 years old, you would multiply 100 X $0.276 = $27.60. The annual cost would be $27.60 X 12 = $331.20. Since life insurance premiums are deducted from your paycheck only 10 months of the year, divide your annual cost by 10 to see what the deduction would look like on your paycheck.

| Hartford Life Insurance | |

| Under 20 | $0.060 |

| 20-24 | $0.060 |

| 25-29 | $0.065 |

| 30 - 34 | $0.086 |

| 35 - 39 | $0.097 |

| 40 - 44 | $0.108 |

| 45 - 49 | $0.180 |

| 50 - 54 | $0.276 |

| 55 - 59 | $0.516 |

| 60 - 64 | $0.713 |

| 65 - 69 | $1.372 |

| 70 - 74 | $2.220 |

| 75 - 79 | $3.588 |

| Dependent Child per | $0.147 |

| | |

Benefit Designation Form.pdf

Benefit Designation Form.pdf

WHO IS ELIGIBLE?

You are eligible if you are an active full-time employee.

Your spouse and child(ren) are also eligible for coverage. Any child(ren) must be under age 26.

CAN I INSURE MY DOMESTIC OR CIVIL UNION PARTNER?

Yes. Any reference to “spouse" in this document includes your domestic partner, civil union partner or equivalent, as recognized and allowed by applicable law.

AM I GUARANTEED COVERAGE?

Basic insurance is guaranteed issue coverage – it is available without having to provide information about your health.

Supplemental child life insurance is guaranteed issue coverage – it is available without having to provide information about your child(ren)'s health. If you are a late entrant, evidence of insurability is required for the full coverage amount.

WHEN CAN I ENROLL?

Your employer will automatically enroll you for basic coverage.

You may enroll in supplemental coverage from 10/26/2020 to 10/30/2020.

WHEN DOES THIS INSURANCE BEGIN?

Basic insurance will become effective for you on the date you become eligible.

The effective date of supplemental coverage is 1/1/2021.

You must be actively at work with your employer on the day your coverage takes effect. Your spouse and child(ren) must be performing normal activities and not be confined (at home or in a hospital/care facility).

To learn more about Life insurance , visit our interactive benefits education tool, MyTomorrow® at

www.thehartford.com/benefits/RSCCD

WHO IS ELIGIBLE?

You are eligible if you are an active full-time employee.

Your spouse and child(ren) are also eligible for coverage. Any child(ren) must be under age 26.

CAN I INSURE MY DOMESTIC OR CIVIL UNION PARTNER?

Yes. Any reference to “spouse" in this document includes your domestic partner, civil union partner or equivalent, as recognized and allowed by applicable law.

AM I GUARANTEED COVERAGE?

Basic insurance is guaranteed issue coverage – it is available without having to provide information about your health.

Supplemental child life insurance is guaranteed issue coverage – it is available without having to provide information about your child(ren)'s health. If you are a late entrant, evidence of insurability is required for the full coverage amount.

WHEN CAN I ENROLL?

Your employer will automatically enroll you for basic coverage.

You may enroll in supplemental coverage from 10/26/2020 to 10/30/2020.

WHEN DOES THIS INSURANCE BEGIN?

Basic insurance will become effective for you on the date you become eligible.

The effective date of supplemental coverage is 1/1/2021.

You must be actively at work with your employer on the day your coverage takes effect. Your spouse and child(ren) must be performing normal activities and not be confined (at home or in a hospital/care facility).

To learn more about Life insurance , visit our interactive benefits education tool, MyTomorrow® at

www.thehartford.com/benefits/RSCCD

.